It’s been a long time coming. Why the long delay?

Sept 2024, the Australia Government passed the Treasury Laws Amendment bill, to include the new introduction of mandatory climate-related reporting requirements for large and medium sized companies, including disclosures on climate-related risks and opportunities, and on greenhouse gas emissions across the value chain, starting in 2025 for the largest companies.

It’s been a long time in the making with 2 fits-n-starts and delays in 2022 and 2023 as mining companies and supplier subsidiaries and beneficiaries – indeed the Government- scrambled for excuses of not being able to meet deadlines to implement ESG mandates/ systems in their organisation.

It’s understandable in that Australia’s economy historically and now, relies heavily on mining economic returns to propel the lifestyles and social services Australian’s are accustomed to enjoying and take for granted. But as renewable energy comes up to speed in cost and implementation, Australia has no more excuses to meet their Climate targets.

Wind and solar power are currently the cheapest forms of new electricity generation in Australia. The latest GenCost report by CSIRO and the Australian Energy Market Operator (AEMO) highlights that the cost of electricity from new-build wind is around A$60 per MWh, while solar PV is about A$70 per MWh. These costs are expected to decrease further in the coming years. Despite the cost advantages, there are challenges such as rising costs for components and engineering, as well as the need for streamlined grid connections and new transmission infrastructure.

Effective on 1 January 2024 the International Sustainable Standards Board (ISSB) unveiled global sustainability reporting with two new standards: International Financial Reporting Standard S-1, the General Requirements for Disclosure of Sustainability-related Financial Information, and IFRS S-2, Climate-related Disclosures – based on ISSB global government input solicitation for the Task Force on Climate-related Financial Disclosures (TCFD), the Sustainability Accounting Standards Board (SASB), and the CDP’s Climate Disclosure Standards Board (CDSB).

Mandatory Climate Reporting within Global Capital Markets as explained by ISSB, not only enables/ enforces cross-border ESG governance and compliance to abate climate change, but also gives company transparency to avoid Green-Washing as an incentive for investors.

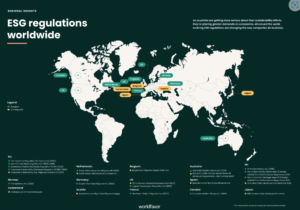

Map of ESG regulations around the world from our Sustainability reporting playbook.

A 2021 novel international dataset by Harvard of ESG disclosure regulations between 2000 and 2017, identified 25 countries that introduced mandates for disclose ESG information to financial institutions, state-owned companies, and large, listed companies.

In 2016, the Singapore Exchange established a comply-or-explain ESG reporting framework, effecting mandatory reporting rules in January 2023 for some listed companies.

In recent years, the Hong Kong SAR and Singapore markets reporting obligation was on a comply-or-explain basis, with in Australia, India, Japan, Thailand, and the United Kingdom, reporting being voluntary.

But this is now changing. Halleluiah!