INSIGHT ASIA CLIMATE FINANCE: IMF + Climate and Nature Philanthropy 2023 Asia Survey + Blended Finance Launches Philippines Offshore Wind Project

Image Credit: Shishka

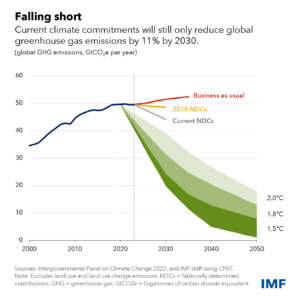

IMF: The World Needs More Policy Ambition, Private Funds, and Innovation to Meet Climate Goals Of the trillions of dollars needed for low emission, climate resilient development, capital exists in the private sector and institutional investors.

-

ClimateWorks Foundation, Philanthropy Asia Alliance and the World Economic Forum, Climate and Nature Philanthropy in Asia Survey, 2023.

Over 50 actors from nine countries were interviewed to gain greater insights, from global (with operations in Asia) and Asia-based philanthropists to the finance community, institutes focused on capacity building and convening, and universities.

Countries in the Asia-Pacific region are at risk of losing 35% of gross domestic product (GDP) by 2050 from the effects of climate change and natural hazards, effectively undoing over 30 years of efforts to reduce poverty, tackle food security and advance human development.

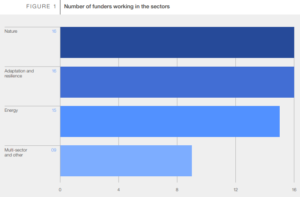

On the philanthropic side, research by ClimateWorks Foundation reveals that giving to prevent climate change remains under 2% of global philanthropic giving annually. From 2017 to 2021, funding to address climate issues specific to Asia was only 12% of global foundation giving to prevent climate change, with 30% of these same funds targeted the US and Canada, and 16% targeted Europe

The next generation of funders is seeking to expand beyond more traditional philanthropic areas to more innovative funding mechanisms.

The survey of 24 funding respondent including both global and Asian philanthropy – with nine of the philanthropies headquartered within Asia and 15 elsewhere, predominantly in the US and Europe. These organizations granted more than $3.7 billion last year, including at least $1.9 billion to climate and nature globally and $580 million to climate and nature in Asia. This figure likely underrepresents total giving from this group.

Increasing awareness is the first step, and beyond this, there is a need for financing support.

Funding for climate and nature in Asia, however, remains insufficient due to the lack of awareness and understanding of applicable implementable solutions to deal with these challenges. Coupled with the lack of structured data collection and measurable outcomes, as well as mismanagement of expectations on the time horizon of delivery, the challenge is exacerbated.

There is great hope in Philanthropic-public-private partnerships (PPPPs).

Greater involvement from the philanthropic community is essential for solving the climate and nature crisis. Within climate and nature philanthropy, funders are increasingly interested in PPPPs. PPPP models are the building blocks for scale. Asian philanthropic forces are growing substantially and can go further and faster through collective action – building capacity and capabilities and bringing together diverse actors to drive dynamic innovation.

-

PHILIPPINES Blending Climate Finance: CLIME CAPITAL Low-Carbon Transition Investor with public and private stakeholders

Blended finance combines public or philanthropic funds with private sector investment to address climate issues.

These public-private-philanthropic partnerships can unlock untapped capital and accelerate transformations across sectors.

Asia is a particularly critical region for achieving net zero, and a new generation of philanthropists across the continent is emerging with a high focus on climate.

One example in the region comes from the Philippines, where an offshore wind project has been conceived and organised by low-carbon transition investor Clime Capital, with collaboration between public and private stakeholders.

Find out more about the project and the importance of blended finance, in this article by the World Economic Forum’s Yvonne Leung, Pak Yin CHOI and Luis Alvarado Martinez.