While investors scramble to navigate Asia’s fragmented clean energy landscape, one developing giant is pulling ahead with explosive growth that’s making boardrooms from Silicon Valley to Singapore take notice: India.

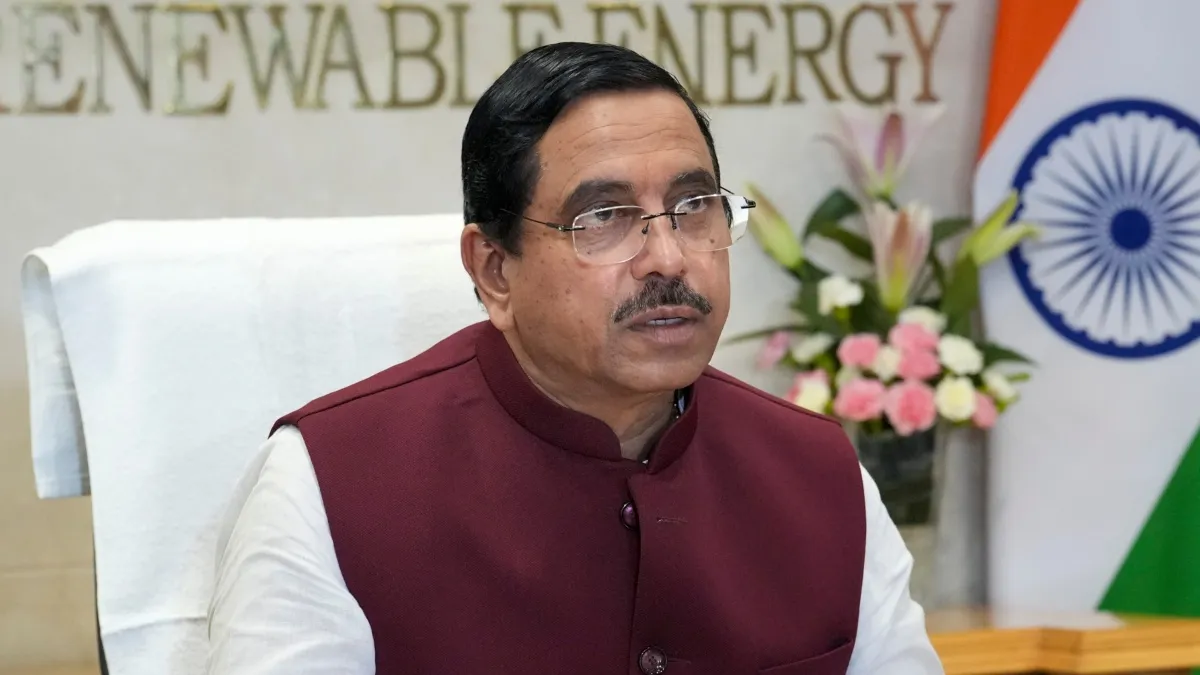

India’s Renewable Energy Minister, Pralhad Joshi states:

“As we step into 2025, India stands tall as a global lighthouse of sustainable development. Our achievements under Prime Minister Shri Modi aren’t merely about meeting targets; they’re about reimagining what’s possible in the worldwide energy transition. Through these initiatives, we’re crafting a blueprint for a future where economic growth and environmental stewardship go hand in hand.”

The numbers tell a compelling story. India achieved record-breaking milestones in 2024 with the addition of 24.5 GW of solar capacity and 3.4 GW of wind capacity, dwarfing competitors and signaling unprecedented momentum in South Asia’s largest economy.

“India’s renewable sector isn’t just growing—it’s exploding,” says energy analyst Rajesh Kumar. “We’re witnessing a transformation that will reshape global clean tech supply chains for decades.”

India now stands as the world’s third-largest renewable energy producer with 46.3% of its energy capacity coming from renewable sources, a remarkable achievement that positions it ahead of regional competitors Vietnam and Indonesia despite their ambitious climate pledges.

The Solar Powerhouse

The solar sector represents India’s crown jewel. Solar power has witnessed a 30-fold surge in adoption, with installed capacity increasing from a mere 2.5 GW in 2014 to about 94.16 GW as of November 2024. This astronomical growth trajectory shows no signs of slowing.

Wind energy tells a similar tale. Wind energy contributed around 47.3 GW to India’s installed renewable energy capacity, making it the second-largest renewable source after solar, with India currently ranking fourth in the world for wind power capacity.

Why India Beats the Competition

While Southeast Asian economies attracted US$605 billion in foreign direct investment in 2024, much of that capital flowed into traditional sectors. India’s advantage lies in its policy clarity, massive domestic market, and aggressive renewable targets that create certainty for investors.

Vietnam and Indonesia, despite announcing carbon neutrality targets and securing Just Energy Transition Partnerships, face infrastructure bottlenecks and regulatory uncertainties that make investors nervous. Eight out of 10 Southeast Asian countries have announced carbon neutrality targets, but significant gaps exist between investment trends and the region’s long-term goals.

The Winning Sectors

Solar Manufacturing: India’s production-linked incentive schemes are attracting billions in panel manufacturing investments, creating an alternative to China-dominated supply chains.

Green Hydrogen: With government commitments exceeding US$2.4 billion, India is positioning itself as a future hydrogen superpower, particularly for industrial decarbonization.

Energy Storage: Battery manufacturing and grid-scale storage solutions are booming as India tackles intermittency challenges in renewable deployment.

Electric Mobility: The EV revolution is accelerating with substantial incentives for manufacturers and charging infrastructure developers.

The Investment Calculus

“When we evaluate Asia’s developing markets, India consistently scores highest on policy stability, market size, and execution capability,” notes Sarah Chen, managing director at Green Capital Partners. “The regulatory framework has matured significantly, reducing investor risk.”

The contrast with competitors is stark. While Indonesia touts its nickel reserves for EV batteries, it struggles with protectionist policies that deter foreign partnerships. Vietnam’s tech ecosystem shows promise but lacks the scale and skilled workforce India offers across renewable sectors.

Major players are committing serious capital, with investments like NTPC Green Energy’s Rs. 80,000 crore (US$9.59 billion) in Maharashtra for green hydrogen, ammonia, and methanol projects, demonstrating the scale of opportunities emerging.

The Bottom Line

For clean tech investors seeking the optimal Asian developing market, India presents the most compelling risk-reward profile. Its combination of rapid capacity additions, supportive policies, enormous energy demand, and improving ease of doing business creates a perfect storm for clean tech deployment.

The question isn’t whether to invest in Asian clean tech—it’s whether you can afford to miss India’s renewable revolution while competitors chase smaller, riskier opportunities elsewhere. With solar, wind, hydrogen, EV’s and storage sectors all expanding simultaneously, India offers diversification that no other developing Asian market can match.

The smart money has already noticed. The only question is: what took you so long?