Foreign companies dominate the huge build-out of solar capacity in Australia. The rate of return in renewables is not based on size and scale, but how early a great project can be acquired in the development process.

While Australia has been on a go-slow / stalled up-take of domestic Renewable Energy investments, foreign investors have been busily positioning themselves for the picking, based on low-cost of investment finance of A$300 – A$800 mil.

Australia business has commented that there’s so much competition, so why as an Origin, or an AGL or an EnergyAustralia, would they try and compete with all of these projects when they have much, much lower costs, and the low returns on offer from investment in solar and wind farms. Therefore, they would largely support renewables through long-term contracts to purchase the output rather than as developers and owners.

Chinese, French, Spanish and several big Asian companies have carved up the fast-growing large-scale solar farm development sector as they tap Australia’s booming growth in renewable energy, leaving major domestic suppliers such as AGL Energy and Origin Energy playing around the edges.

Although household-name local electricity suppliers AGL and Origin are among the biggest half-dozen owners and developers of batteries, they are missing from the top 15 in the utility PV and wind space.

International companies have invested heavily in experienced management with deep development backgrounds at the local level, giving them an advantage over large domestic retailers. Companies such as AGL and Origin still largely control which projects get developed and when, therefore retaining significant influence over how the market develops.

“This means that deal flow is being directed towards international utilities, and that the historically large retailers in Australia are finding it hard to engage and get the right projects at the right price and with the right risk profile,” says Matthew Rennie, a former senior EY partner and now co-CEO of independent consultancy Rennie.

AGL chief operating officer Markus Brokhof says making a case to invest in wind and solar farms is “tricky”, and that AGL will typically look to underwrite third-party projects through long-term power purchase agreements rather than own the assets.

Beijing Energy International (BJ Energy) is the largest owner of utility-scale solar projects in Australia through the acquisition of the Australian assets of Lightsource BP a European-owned developer for A$813 mil in Dec. 2023 – followed by France’s Neoen with a takeover offer of A$10 bil from Canadian Brookfield (Rystad Energy)

Spanish heavyweights Acciona, Iberdrola and FRV also count among the top 10 owners and developers of utility solar plants that are either already operating, or under construction. Philippines-owned ACEN and Malaysia’s Gentari, which secured its entry into the domestic market last year through the acquisition of the Australian business of Germany’s Wircon, also feature.

In contrast to solar, two local entities – Andrew Forrest’s private energy company Squadron Energy and AGL-affiliated Tilt Renewables – rank as the biggest developers in the wind power sector, according to the data- followed by European companies, notably French-owned TagEnergy (thanks to its commitment to the $4 billion Golden Plains wind farm in Victoria), Acciona and Iberdrola.

There are about 300 wind farms in various stages of development across Australia, compared with more than 700 utility-scale solar farms.

The planning processes in developing wind farms are the large modern obtrusive turbines, is less attractive for local communities than solar and batteries- and more expensive on a dollar-per-watt of capacity installed due to high project costs.

AGL has a 500 MW battery under construction in central NSW on a April 2023 shut down a coal-fired power station, and is bringing a 50 MW battery online at Broken Hill NSW. In March 2024, AGL formed a JV with Someva Renewables, for the development of the Pottinger Energy Park in south-west NSW, which is expected to include a 500 MW, four-hour battery.

Origin has approximately 1 GW of committed battery projects and contracted third parties across NSW, Victoria and Queensland – with further potential battery storage opportunities of 2 GWh and 3 GWh in its portfolio.

AGL and Origin among the top developers of large batteries makes sense because of the higher value of storage assets – but banks are not comfortable lending to battery projects that have significant exposure to the merchant market, where cash flows are less assured.

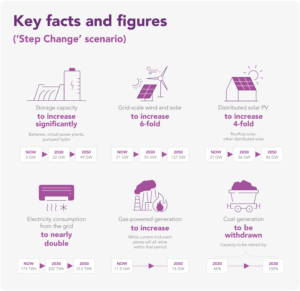

The Australian Energy Market Operator (AEMO) released in June 2024, a 25-year roadmap to transition the National Electricity Market (NEM) to net zero by 2050.

The Integrated System Plan (ISP) is the result of two years of consultation, analysis and review involving 2,100 stakeholders, 85 presentations and reports, and the consideration of 220 formal submissions.

The ISP confirms that renewable energy connected with transmission and distribution, firmed with storage, and backed up by gas-powered generation is the lowest-cost way to supply electricity to homes and businesses as Australia transitions to a net zero economy.

The ROAD-MAP of The Australian Energy Market Operator (AEMO) release HERE>>