FIRSTLY, let me begin with a few key explainers for perspective.

China’s Guangxi Gateway: ASEAN’s Back Door… Guangxi is China’s strategic bridge to ASEAN: 1500km coastline, three major ports, and the Pinglu Canal (2026) linking Beibu Gulf to the Pearl River Delta. Cross-border freight to Vietnam jumped 170% under Belt and Road.

Green Finance Innovation: Zero-Carbon Digital Cash… Guangxi pioneered China’s first “Zero-Carbon” cross-border transfer using Digital RMB with Vietnam, integrating Carbon Emission Reduction loans with real-time emissions tracking — a blueprint to solve Southeast Asia’s 15% financing cost crisis.

Australia’s Carbon Debt: CBAM Reckoning… Australia exports 2.9 billion tonnes of embedded CO₂e annually (iron ore, coal, LNG, raw lithium) with zero value-add. EU CBAM (2026), UK CBAM (2027), and likely Chinese carbon pricing (2030) will slam Australia’s top three export earners without domestic decarbonisation.

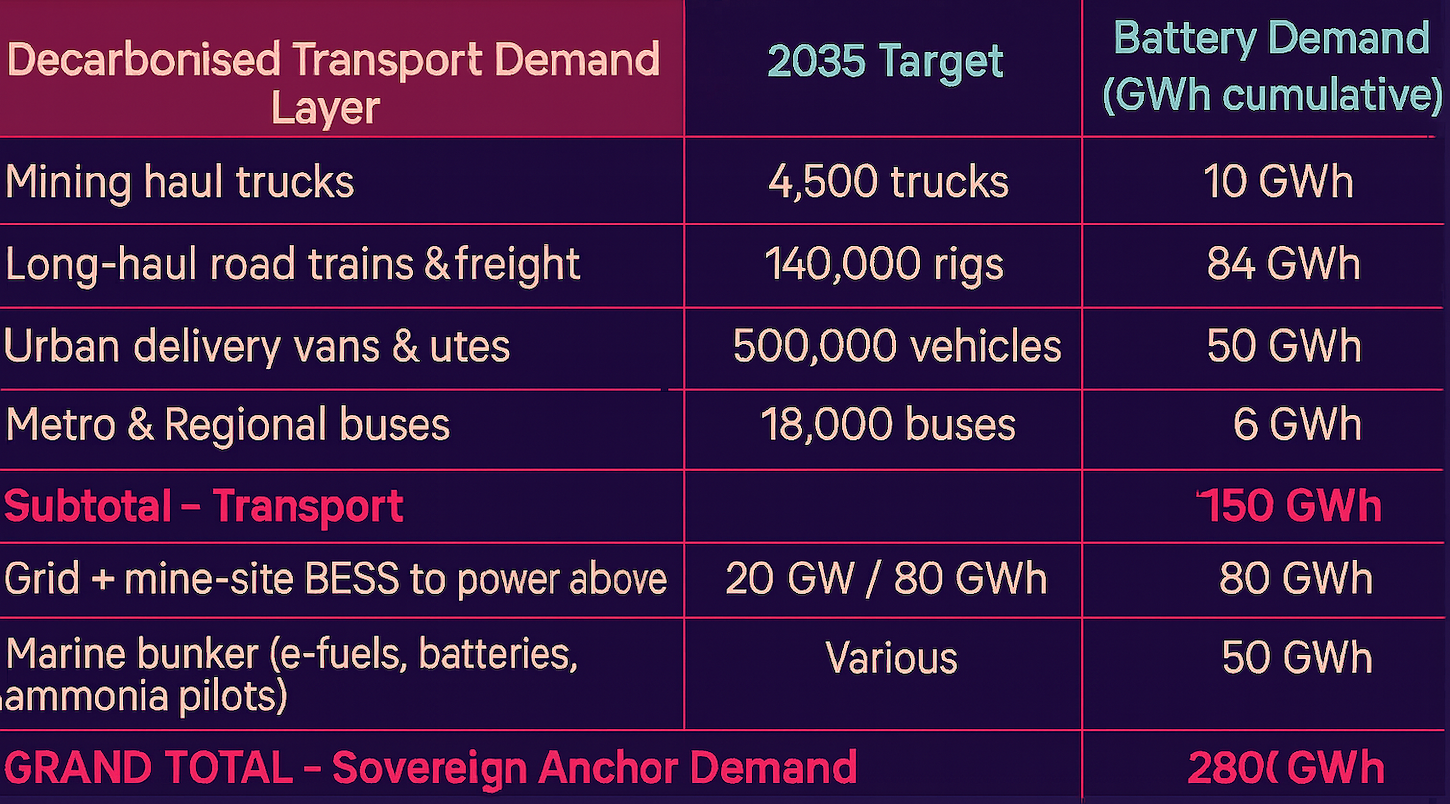

The 280 GWh Solution: Electrifying Australia’s mining trucks, road trains, and fleets creates 280 GWh demand — justifying 2×50 GWh gigafactories, pCAM refineries, battery recycling, and truck assembly. The export prize: ASEAN, Pacific, and Africa need exactly these products (tropical bus packs, mining batteries, rugged BESS) built for harsh conditions.

The Bridge: Chinese battery makers (FinDreams/BYD) could decarbonise Australian fleets, meeting dual-carbon commitments while creating regional export capacity — if Canberra stops sending lithium to US reserves and backs strategic Chinese investment.

Postcards From China’s Green Economy

With all of the above taken into account, here I am in the Guangxi Zhuang Autonomous Region this week attending an International Green Economy Forum hosted by the Guangxi Government’s Ministry of Commerce and China’s Association of Green Industrial Parks (GPIPC).

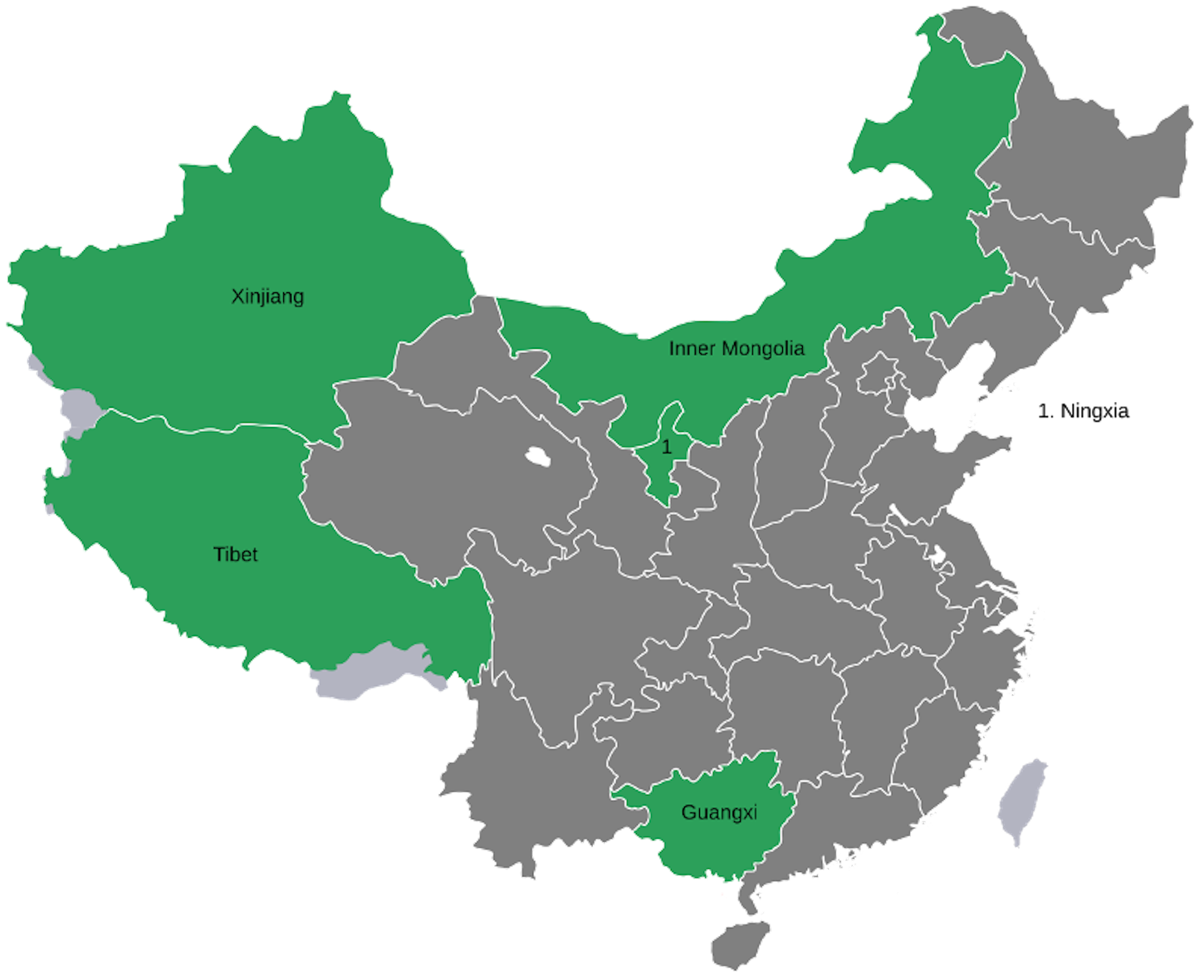

Few Australians could point to Guangxi on a map, yet it is likely to become a priority location for DFAT before long. Positioned west of Guangdong and sharing a border with Vietnam, it has emerged as one of China’s most important gateways to ASEAN.

It’s warm in the capital Nanning this week for this Green Industry Cooperation Forum, compared to Northern China’s December Winters, it seems like Spring all year round here.

I’m joined at the forum by attendees from Finland, Belgium, Denmark, France, Switzerland and US, and we’re here to promote linkages with China’s Green Industrial Zones overseas.

But we’re all here to hear more about what Guangxi is up to with their Guangxi–ASEAN Economic and Technological Development Zones, including the expanded Beihai Economic and Technological Development Zone on the Coast, including the exciting new Tieshangang Offshore Industrial Zone, the Longtan Industrial Park of Yulin City the Yanghe Industrial New Area of Liuzhou City.

Guangxi has a 1,500km coastline facing the South China Sea. If you know your history you’ll be across the region’s role in the Sino-French War in 1884, and the Qing Empire’s loss of Vietnam tributaries to the French in the battle of the Gulf of Tonkin, adding to the foreign nibbles at Kowloon (Hong Kong), Xiamen, Ningbo, Shanghai, Qingdao and Dalian.

Some of China’s major ports, 150 years on, are now in Guizhou (Beihai, Qinzhou and Fang Chenggang), and they certainly ain’t going to let that snafu happen again.

One of China’s Five Autonomous Regions

The Guangxi Autonomous Region (广西壮族自治区), is one of China’s five autonomous regions, designated to support the Zhuang people, China’s largest ethnic minority group.

For 22 years, China-ASEAN exchanges have been happening on every aspect of trade and investment: from health to tourism, environment and conservation and goods and services.

At the same time as Guangxi has been building international people-to-people links, the region itself has been undergoing quite an infrastructure transformation, positioned now as the land, sea and air bridge with ASEAN, and more recently, Pacific Island Nations.

Longmen Bridge (above), Qinzhou, is China’s longest cross-sea bridge, opened across the Beibu Gulf in Guangxi in December 2024 and linking Qinzhou Port with Fangchenggang Port as part of the Guangxi-Binhai expressway, cutting travel time from 1.5hrs to 25 minutes.

There are 50 million people in Guangxi, and it relies on – much like Australia – Agriculture (China’s largest sugarcane producer), rice, fruits, and mulberry (for silk). Key industries include non-ferrous metals (aluminium, manganese), machinery manufacturing, auto manufacturing and chemicals.

Tourism is also a major contributor. Think Vietnam “with Chinese characteristics”. But it is the development in trade and logistics (part of China’s Belt and Road Initiative) that is of most interest, especially the New International Land-Sea Trade Corridor worked on through this last 14th 5-year plan, linking western China to Southeast Asia via a network of physical rail, land seaports, (a 170% increase in cross-border freight to Vietnam).

But also more importantly, the links build up through ‘soft’ bridges like the China-ASEAN exchanges, China-Cambodia Industrial Park, China-Malaysia Industrial Park, and Guangxi-Brunei Economic Corridor.

New highways and bridges between ports, high-speed rail connecting Nanning to Guangzhou and Kunming in under three hours, and a whole new canal being dug North from the coast to connect with China’s intricate inland water freight network.

With all this development, Guangxi is still home to much of China’s leading Environmental Conservation activities. The region is home to several nature reserves and UNESCO Global Geoparks, focusing on karst ecosystem protection.

China’s Decarbonisation Agenda

The Tieshangang (Coastal) Industrial Zone might not be on everyone’s bucket list, but it was on mine, and many of the European delegates. Not that I’m that into Container Ports, I live in Ningbo! It is more to see the transition of a coal-powered industrial zone to be a green economy superpower.

Guangxi has approvals for 8GW of offshore Wind by 2030, and the Port is now a bustling Offshore Wind industrial base. Certainly worth a visit for those surviving Australian East Coast offshore Wind players.

The nation’s first integrated manufacturing base combining offshore wind power converter stations with floating wind turbine equipment, the base has attracted leading enterprises including China Three Gorges Corporation, Goldwind Science & Technology, CRRC Equipment and Bluewater Technology.

Kind of what Australia needs?

So what am I talking about here? Net Zero, Faster, Together.

You see, I have a dream. Australia and China working together to decarbonise supply chains.

Financing the Transition with Zero-Carbon Cash

Guangxi has recently delivered on a number of firsts in the integration of Green Finance + Digital RMB. They have implemented China’s first loan combining the Carbon Emission Reduction Facility, Sustainability-linked mechanism and Digital RMB.

They have also pioneered a “Zero-Carbon” cross-border financial service model, successfully completing the country’s first “Zero-Carbon” cash cross-border transfer, marking a breakthrough in China–Vietnam green and low-carbon financial cooperation.

And they have a cool real-time emissions tracker on their metals smelting industry.

My Battery Addiction

Closer to home, some exciting meetings with FinDreams Battery Co Guangxi 弗迪电池 (a BYD subsidiary), provided insights into their appetite to invest in battery manufacturing in Australia.

FinBatt recently built a 10GWh hybrid plant in Nanning, and another 5GWh in new LFP/ Na manufacturing of new energy battery cells and modules, supported by full-process production workshops including electrode manufacturing, stacking, assembly, testing and pack production.

Reversing Australia’s Carbon Debt

For thirty years, Australia has run up a big carbon tab in exporting emissions.

- Iron ore → 1.7 billion tonnes of embedded CO₂e exported annually overseas

- Coal & LNG → another 1.2 billion tonnes CO₂e when burnt

- Lithium → 170,000 t LCE shipped raw every year, zero value-add here

And the bill is coming due in the form of EU’s CBAM (2026), UK CBAM (2027), and almost certainly a Chinese consumption-based carbon price by 2030.

If we do nothing, our three biggest export earners get slapped with border taxes.

Dealing with this is what I’ve been talking about with battery (and recycling) friends in China.

Decarbonising supply chains in Australia to help China’s corporate dual carbon commitments.

Australia’s Potential Battery Demand Stack

So just image if we flipped all the diesel drinking heavy fleets to battery electric. How much ‘demand’ would that create to justify a domestic Australian battery manufacturing industry?

What we’re proposing to our battery friends in China is to come help us decarbonise our mining and transport sector and then support meeting the some 20× increase in demand in the next ten years.

What 280 GWh of locked-in local demand means in battery + vehicle production capacity

- 2 × 50 GWh (pa) battery gigafactories

- 2 × pCAM / CAM refineries (essential missing piece in Australia’s industrial aspirations)

- 1 x green hydrometallurgy (battery-grade) battery recycling plant (+ recovery infrastructure)

- 2 × heavy-truck/ bus assembly plants

- Manufacturing, maintenance + indirect jobs

- Supply chain vertical integration from mine → pCAM → cell → pack → truck → use

The Global Bonus – Our Neighbourhood is Desperate

ASEAN + Pacific + Africa need exactly what we would be making:

- 500 kWh mining trucks for Indonesia & PNG nickel/copper

- 600 kWh road-train packs for Indonesia & Philippines

- 350 kWh tropical-rated bus packs for Jakarta, Manila, Suva

- Rugged 50–100 kWh BESS for remote micro-grids

Built and supported under Australian conditions: we could own that export market for decades.

If Only we weren’t already quietly funnelling our best lithium into a US strategic reserve for refining. Every offtake agreement we sign with America today is a gigafactory we will never build in Australia tomorrow.

Canberra has a binary choice:

Keep running the world’s largest carbon credit card and hope customers keep paying the bill…

or…

Cancel the card, decarbonise our fleets, and turn 280 GWh of sovereign demand into the most powerful industrial-policy magnet on Earth.

The lithium is in the ground.

The demand is in our fleets.

The technical support is next door.

All that’s missing is the political will to start building bridges and support target, strategic Chinese investment.

What are we waiting for?

I really like what you guys are up too. This kind of clever work and exposure! Keep up the superb works guys I’ve incorporated you guys to my blogroll.

Thank you Jesse! Your encouragement is greatly appreciated. Have a great day!