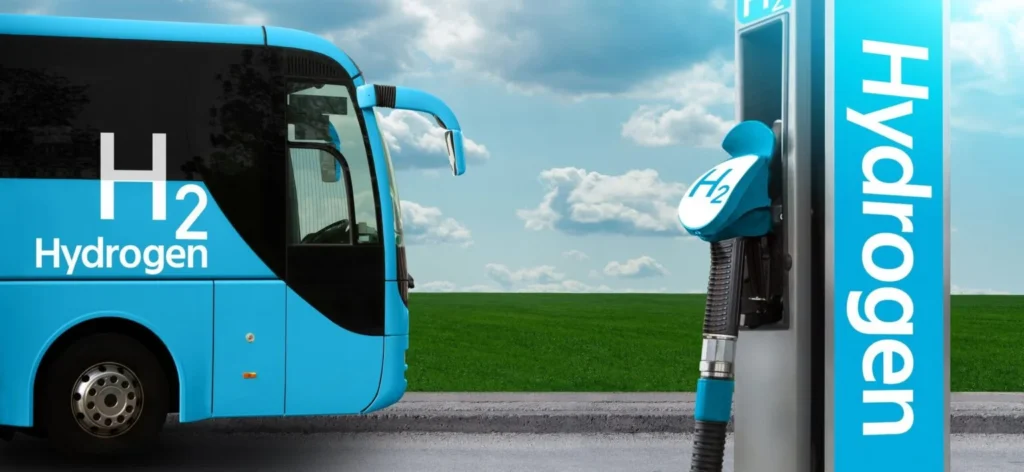

India’s first Green Hydrogen Fuel Cell Bus parked at India Gate New Delhi September 2023.

Indian Oil + Tata Motors unveils India’s first Green Hydrogen Bus which only emits water- but is the cost is inhibitive for full-scale production?

India’s first experimental trial of Hydrogen Fuel Cell buses was launched in Q4 2023. Developed under a joint venture involving the Indian Government company, Indian Oil Corporation Ltd., and Tata Motors, they aim to have 3 buses on the road as we write.

It is envisaged that the success of this pilot trial of Hydrogen busses in India – which only emits water vapour at their tailpipe – would save India millions of tons of carbon emissions annually going into the environment, plus the affiliated costs of healthcare, livelihoods, and jobs.

Hydrogen busses “fuel cell” batteries are more sustainable than Electric batteries because they do not deteriorate and can keep running as long, as they have a steady supply of Hydrogen.

So how long does it take to recharge a Hydrogen Bus? Hydrogen offers higher energy density compared to electrical storage systems such as batteries, this enables a longer range compared to systems where the batteries are used as stores of energy. Refueling hydrogen buses takes on average around 7 minutes, with global patented designs being developed to allow less than 5 minutes. Short-range buses use up to 350kW taking as little as 5-10 minutes to charge.

The hydrogen fuel cell bus relies on two energy sources, hydrogen and oxygen. The hydrogen reacts with oxygen across an electrochemical cell — similar to a battery—to produce electricity, water, and small amounts of heat through electrolysis. Most commercial electrolysis units on the market today advertise that they require between 10 and 11 L of deionized water per kg of hydrogen produced amounting to 1kg of hydrogen (requiring 39 kWh electricity) = 97km 1+ hours (60 miles). Hydrogen is also highly inflammable substance and explosive in nature and therefore cannot be easily transported from one place to another.

But here’s the catch: Green Hydrogen transport “fuel cells’ are currently approximately 10x more expensive to produce than Electric batteries and 3 x more than current fossil fuel petrol.

According to a 2023 USA MIT climate article a comparative cost analysis between Electric viz Green Hydrogen vehicles was surprising. The total cost of ownership for hydrogen was around 40 percent higher than a comparable fossil fuel petrol vehicle, and about 10 percent more than an EV.

This may change due to the dependence on a lot of minerals which are needed and mined that go into making a lithium-ion batteries Nickel Manganese Cobalt (NMC), and variations with graphite, nickel, aluminum, copper, manganese, cobalt, and iron. Innovations to make hydrogen cleaner and cheaper could help make fuel cell vehicles competitive once again. So, too, could changes in the EV market.

Batteries depend on minerals mined overseas and sometimes under problematic conditions. A shortage in those materials, or geopolitical turmoil in the countries that produce them, could raise the price of EVs—and make made-in-the-India hydrogen appealing by comparison.

Photo Credit: ANI-India

In 2022, Tata Motors was manufacturing 10,000 EVs per annum – in 2023 EV’s were set for 50,000 vehicles

These figures includes the recently introduced the Tata Tiago EV as well as the Tata Punch EV slated for launch in 2023. The company had sounded out vendors on an assured production plan of 50,000 EVs in fiscal 2023 and scaled it up to 125,000-150,000 units annually in the following two years.

The Electric busses / vehicles with a battery use-by-date of approximately seven – twelve years, requires substantial investment and expertise in setting up e-waste management facilities for circular value chain of recycling and repurposing. Batteries removed from e-buses still have many years of useful life in grid storage, an essential part of the charging system for the buses for a further 10-15 years – to avoid going to landfill – which in effect, would cancel-out some of the zero-emissions measurements.

Currently, India has 12,000 e-buses in operation and aiming to achieve 50,000 electric buses on its streets by 2027 through the joint ‘finance mechanism’ – designed to mitigate manufacturer’s risk seeking loans to expand production rather than the previous model of long-term debt from lease backs as implemented in the past to stimulate uptake – with a US$390mil stimulus fund consisting of the Indian government’s US$240 mil investment and the US government and NFP’s injection of $150mil.

Read More here+

For further reading on the Pros and Cons of Green Hydrogen from UK independent research and technology organisations TWI access here+