Asia-Pacific will continue to lead global wind turbine market contributing 43.06GW out of the total 77.37GW WTG installed worldwide in 2022

Asia-Pacific has the largest market share in global wind turbine installations, surpassing the EMEA and Americas regions. The growth in the APAC region is largely contributed by China, which has established comprehensive development plans focused on utilising renewable energy to sustain its growth and ambitions of becoming a global leader in technology development.

However, challenges and limitations of wind energy faces are economic challenges due to higher costs compared to conventional sources – transmission costs from offshore wind farms can be significant – and wind is intermittent nature requires complementary energy sources for stable supply.

Countries such as India, Australia, Republic of Korea, and Japan have set specific renewable generation targets for the next decade, making the region a major market for wind turbines and other associated equipment, and services.

Australia: Wind power is currently the cheapest source of large-scale renewable energy in Australia, with a total installed wind capacity reaching approximately 9,100 megawatts (MW) as of October 2023. Wind power represents 5% of Australia’s total primary energy supply and a substantial 35% of its renewable energy supply.

Golden Plains On-Shore Wind Farm is the largest in Australia situated near Geelong, Victoria, built over 2 phases, with an estimated AU$3 bil investment to power over 765,000 homes generated from 122 turbines, with planning approval for up to 228 turbines across 16,739 ha. An installed capacity will be more than 1,330 MW producing more than 4,000 GWh of green energy annually, with the first phase being completed by 2026.

South Korea: As of the end of 2022, South Korea had a total installed wind capacity of 1,809 MW. There are 115 wind farms with a total of 779 wind turbines across the country. Current Projects: A Singapore-based subsea engineering company, G8, received approval to build a 1.5 GW offshore wind farm off the south-west tip of South Korea. This project will be an important step for both G8 and the South Korean Wind Power industry, as it will be one of the largest offshore wind farm projects in Asia to utilize our next generation energy storage technologies, offering our commercial and utility clients a complete and long-lasting energy storage solution”, said Gerald Tan, Managing Director of G8 Group.

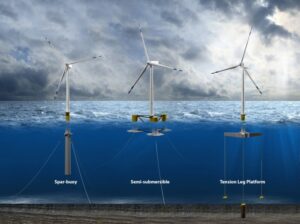

Offshore Wind Farms Use Undersea Cables to Transmit Electricity to the Grid: Electricity produced by offshore wind turbines travels back to land through a series of cable systems that are buried in the sea floor. This electricity is channelled through coastal load centres that prioritise where the electricity should go and distributes it into the electrical grid

Offshore wind projects typically take up to 4 years to finalize due to the extensive geoscience efforts required for regulatory site characterization and project design essentials optimisation.

Japan:

Japan has added 572.3 MW of new wind capacity in 2023, resulting in a total operational wind energy capacity of 5,213.4 MW for the first time, according to preliminary data published by the Japan Wind Power Association (JWPA). As for offshore wind, the country had 153.5 MW of installed capacity at the end of last year, not including semi-offshore wind farms accessible from coastal areas.

According to data, 158 new wind turbines were connected to the national grid in 2023, bringing the total number of operational units to 2,626 by the end of last year. Japan currently has six operational offshore wind farms, with two of them being large-scale, the 84 MW Noshiro Port and the 54.6 MW Akita Port projects. Japan’s semi-offshore wind projects comprise a total installed capacity of 34.2 MW, spread across four wind farms.

Targets and R&D:- Japan aims to achieve 10 GW of wind power capacity by 2030 – and allocated a national wind energy research and development budget of 8.28 billion JPY (approximately 74.5 million USD)