Australia could turn megawatts into megabytes — and potentially billions of dollars — by positioning itself as Southeast Asia’s preferred data centre hub.

Artificial intelligence, cloud migration, and digital economies are accelerating across the region, with data centres becoming mission-critical—and energy-intensive—backbones of growth.

With AI driving surging demand, especially in fast-growing markets like Indonesia and Vietnam, the region’s need for storage and processing power is set to explode.

Co-founder of Atlassian, Scott Farquhar, argues Australia has the edge: plentiful clean energy, political stability, access to advanced US-made chips, and a strong local talent pool. Despite high labour costs, low-cost renewable energy and domestic resources make Australia surprisingly competitive.

“We should power the region,” Farquhar said in a recent speech to the National Press Club. “There are more users of ChatGPT in the combined Indonesia and Vietnam than there are in the United States.”

The main hurdles? Faster planning approvals and infrastructure rollouts to meet the scale of opportunity.

Australasia’s Data Centre Landscape

Australia hosts over 214 data centres, spanning Sydney, Melbourne, Brisbane, Perth, Canberra, and Adelaide, operated by players like NextDC, Macquarie Technology Group, DCI, and GreenSquareDC™. Investments range from A$70 million in Adelaide to A$1 billion hyperscale projects in Perth.

Energy-wise, data centres currently account for approximately 5% of Australia’s electricity use, potentially rising to 8–15% by 2030 amid the AI boom.

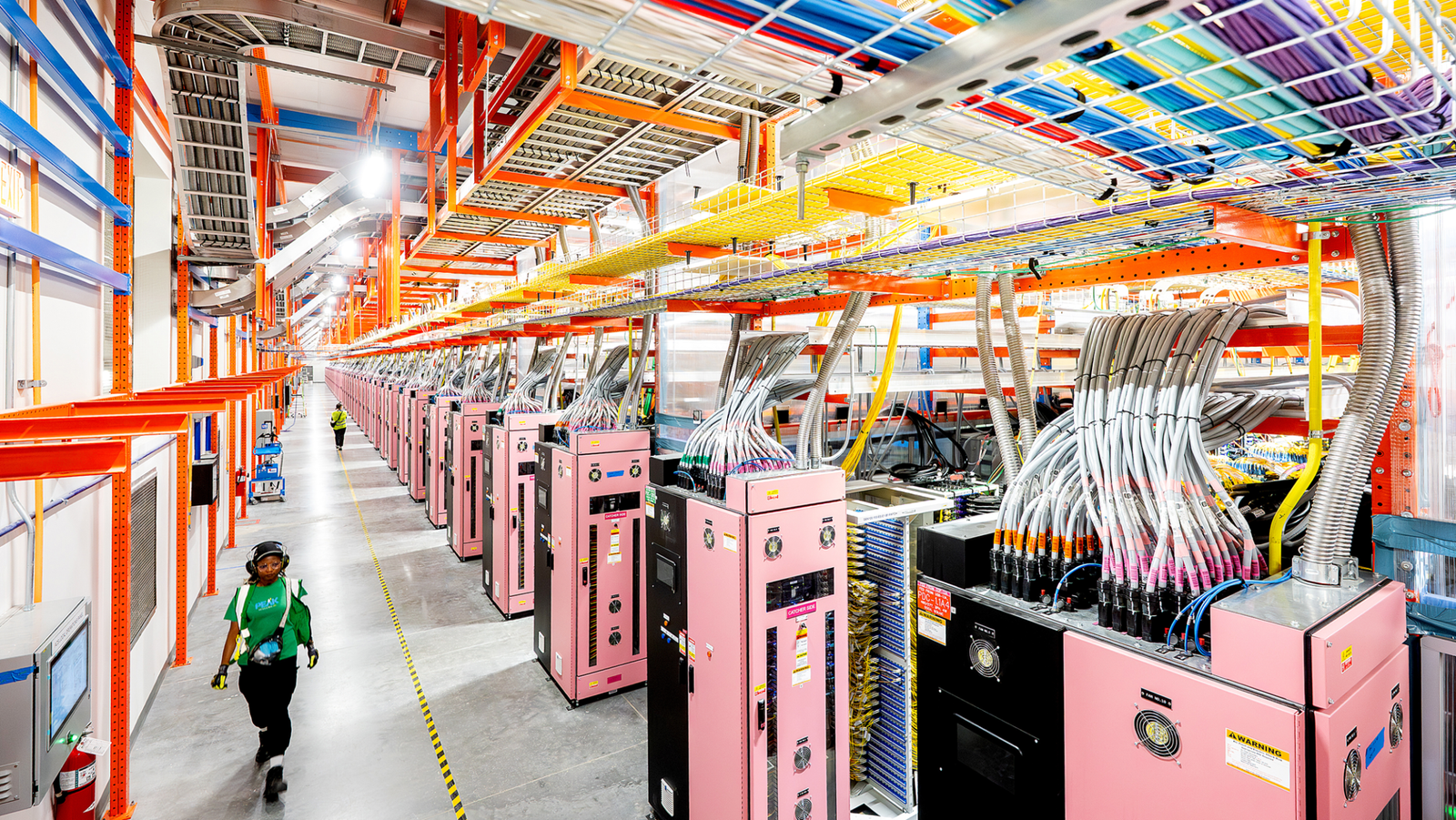

Amazon last announced plans to invest a new total of AU$20 billion from 2025 to 2029 to expand, operate, and maintain its data center infrastructure in Australia. AWS has trained 400,000 + people in Australia since 2017 to develop digital skills with continued support of AI programs such as AWS AI Spring Australia and AWS Generative AI Accelerator.

Image: Pexels

Globally, electricity demand from such centres is expected to nearly double from 415 TWh in 2024 to 945 TWh by 2030. Innovation is already underway: cooling efficiencies, waste-heat recovery, geothermal cooling (e.g., at Pawsey Supercomputing Centre), and proximity to renewable energy projects are being leveraged to reduce environmental impacts.

Southeast Asia & India: The Digital Surge

Southeast Asia—including Singapore, Malaysia, Indonesia, Thailand, Vietnam, and the Philippines—is exploding as a data centre hub. Singapore leads with ~100 facilities, followed by Indonesia (~79), Malaysia (~55), Thailand (~39), and Vietnam (~32).

Energy demand is soaring: Malaysia’s electricity use for data centres could climb from 9 TWh in 2024 to 68 TWh by 2030—approaching 30% of the nation’s power demand. Emissions could rise sevenfold. Indonesia’s emissions may quadruple; the Philippines could see a fourteen-fold increase.

Singapore, constrained by limited land, is turning to offshore solar arrays and cross-border energy imports to power its expanding data centre industry while cutting emissions. A notable move came when Equinix signed a power purchase agreement with Sembcorp, securing supply from a 75-megawatt peak solar project.

Japan, meanwhile, is tapping its abundant hydropower and geothermal reserves to fuel data centre growth, particularly in cooler regions like Hokkaido. Under its 2020 “Green Growth Strategy,” the government has set a 2050 net-zero target, requiring operators to incorporate renewable sources into their energy mix.

To moderate impacts, 30% of data centres in ASEAN are expected to run on solar or wind by 2030—with strong policy support essential to ensure sustainable growth.

Malaysia is advancing with green infrastructure: AirtTrunk is installing rooftop solar and PPAs, while YTL’s Green Data Center Park in Johor will house a 500 MW solar farm and NVIDIA-powered AI computing facilities.

Thailand has approved significant investments—in excess of 90.9 billion baht—to bolster its data centre and cloud sectors.

India continues its rapid expansion. As of early 2022, about 138 centres provided 950 MW capacity, projected to nearly double to 1.8 GW by 2026. Navi Mumbai remains the dominant hub, accounting for 44% of data centre capacity, with major global players like Google and Microsoft investing heavily.

Can Australia Become a Regional Data Hub?

Image source: Amazon

The integration with infrastructure like Snowy Hydro 2.0 or solar farms will determine whether Australia cements its role as the APAC’s green, resilient data backbone.