HONG KONG generates less than 1% renewable energy while sitting on infrastructure capable of 10%. Australian solar expertise could crack the regulatory maze. Keep reading to learn how to set-up a Hong Kong legal business entity in 3 weeks and 17% tax; and what steps / strategy to take to start to start negotiating deals.

Hong Kong is a city of sharp contradictions. It boasts more skyscrapers than anywhere else on the planet, yet around 40% of its land is protected as country parks. It ranks second globally for billionaire concentration, but its own government has run budget deficits in five of the past six financial years. And despite having around 233,000 rooftops, the world’s most vertical city is leaving a solar opportunity worth tens of billions of dollars untapped, while continuing to import almost all of its electricity from fossil fuels.

Hong Kong Environment and Ecology Bureau EEB

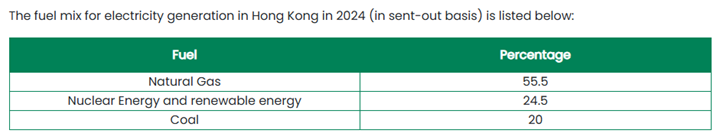

Hong Kong’s renewable share is currently extremely small. Under 1 % of electricity from true renewables (wind/solar/waste‑to‑energy), with most of the “zero‑carbon” share coming from imported nuclear.

Solar electricity capacity reached just 1.44% in 2023, making Hong Kong one of the worst performers globally for renewable energy adoption despite having potential annual solar output reaching 4,674 GWh—or 10.7% of Hong Kong’s energy consumption—from rooftop installations alone.

To put this into perspective: Belgium (population 11.59 million) generates 12% from wind and solar, Serbia (6.8 million people) gets a third of power from renewables, and Singapore used waste, biomass and solar to generate 4.4% of electricity. Hong Kong, one of Asia’s wealthiest and most technologically advanced cities, can’t even break 2%.

But this failure represents a massive opportunity for Australian solar companies that can navigate Hong Kong’s regulatory system and bring world-class expertise to a market desperate for solutions it doesn’t know how to implement.

Research shows 233,000 of Hong Kong’s 309,000 buildings are suitable for installing PV panels with total area of 39 km².

If even half were developed, we’re talking about a market worth $20-30 billion at current installation costs—and that’s before factoring in battery storage, grid integration, and ongoing maintenance contracts.

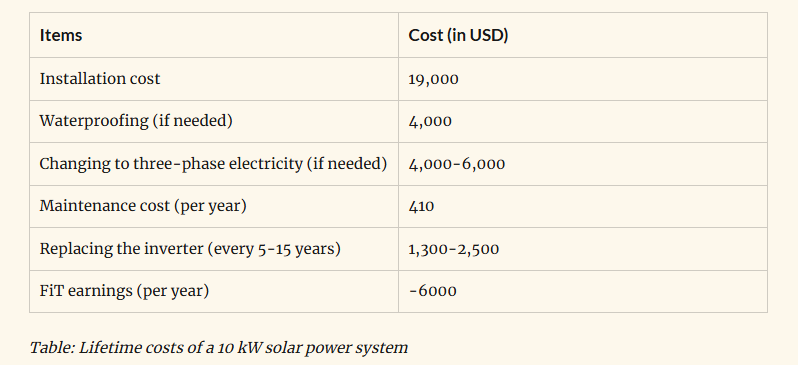

The Hong Kong government launched a generous Feed-in Tariff (FiT) program in 2018 that pays USD$0.39 to USD$0.64 per kWh, much higher than Indonesia’s USD$0.06-0.014, Thailand’s USD$0.2, or Vietnam’s USD$0.15. That’s extraordinary financial support that makes projects immediately viable.

The response? In the 10 years before 2018, only 200 non-governmental renewable energy systems were connected to the grid. Since then, as of March 2025, around 26,800 FiT applications have been approved, and around 25,000 systems have been connected.

A $30 Billion Opportunity Hiding in Plain Sight

For Australian solar companies, energy storage providers, and clean tech firms: Hong Kong isn’t just another export market. It’s a proving ground for cracking Asia’s regulatory complexity, a reference market for broader regional expansion, and a $30 billion opportunity that’s waiting for someone brave enough to navigate the maze. Australia has that expertise, plus geographic proximity, cultural compatibility, government backing, and a proven track record.

If all building rooftops were covered in solar panels, electricity output could be increased to 2.66TWh – 5.98TWh, equivalent to 5.9% – 13.4% of Hong Kong’s 2019 electricity use. At current installation costs, that’s a market worth HK$200-300 billion (US$25-40 billion) over the next decade.

The Hong Kong Polytechnic University estimated that rooftop solar PVs alone could account for more than 10% of Hong Kong’s electricity use, meeting the Hong Kong’s Climate Action Plan 2050’s goal of increasing the share of renewable energy in the electricity mix to 7.5% to 10% by 2035, the first step to reaching carbon neutrality by 2050.

For Hong Kong to reach the modest target of generating up to 2% of electricity from solar power by 2035, the Feed-in Tariff Scheme, such as offering longer-term contracts for new installers, instead of setting a hard sunset provision in 2033, seems more realistic and supports their Paris Agreement. Hong Kong has developed its own climate policies aligned with the Paris goals, including emissions reduction targets, renewable energy strategies, and a carbon neutrality goal by 2050.

Why the Blockage? It’s Not What You Think

The barriers aren’t primarily financial or technical but bureaucratic, informational, and cultural. And that’s precisely where Australian companies with cross-cultural expertise can dominate.

The Regulatory Maze

A recent population survey shows that besides the lack of information on the technology, the different and complicated safety regulations as well as the non-transparent provider structure are barriers to the further expansion of solar projects.

Individuals were the group most exposed to market, policy, and regulatory barriers and they had to contend with the highest number of barriers, with research identifying key obstacles including:

- Technical barriers: Space limitations, structural assessments, roof leak concerns

- Economic barriers: High upfront costs, long payback periods (despite generous FiT)

- Regulatory barriers: Building code restrictions, safety certificate requirements, insurance complexities

- Market barriers: Non-transparent provider structures, lack of one-stop-shop solutions

Installing solar panels in high-rise apartment buildings or commercial buildings often faces more challenges compared to those in detached houses. High-rise rooftops often have practical functionality such as equipment rooms, pipelines, outdoor air-conditioning units, suspended platforms, landscaping, recreation spaces, and fire refuge areas already occupy space.

Here’s where Australian companies gain competitive advantage: The development of a one-stop-shop solution for the installation of solar projects in Hong Kong by the two utilities could help to reduce the bureaucratic hurdles, including all relevant steps for construction and approval of safety certificate, building insurance, acceptance of commissioning. Australian solar firms that can package regulatory navigation, technical installation, and ongoing management into turnkey solutions will capture premium margins that Chinese manufacturers focused purely on hardware cannot match.

The Australian Advantage: Proven Track Record in Challenging Regulatory Environments

Around one third of Australian households have roof-top solar power—the highest in the world. Australian companies have navigated complex state-by-state regulations, utility monopolies, and grid integration challenges that mirror Hong Kong’s obstacles.

Australian companies are already designing and installing large-scale concentrating solar generation systems in Asia and pioneering the development of photosynthetic dye solar cells, demonstrating technical credibility regional markets respect.

Superior Technical Integration Capabilities

The Australia Solar Power Market size in terms of installed capacity is expected to grow from 43.5 gigawatt in 2025 to 85.5 gigawatt by 2030, at a CAGR of 14.47%, with Australian developers winning projects by optimizing battery integration and navigating compliance rules.

Hong Kong’s grid needs exactly this kind of sophisticated integration expertise as it moves beyond simple rooftop installations to complex building-integrated photovoltaics (BIPV) and virtual power plant (VPP) configurations.

Cultural and Regulatory Compatibility

Australia’s common law legal system, British-influenced regulatory frameworks, and English-language business culture align naturally with Hong Kong—a former British colony that still operates under similar governance structures. Australian executives don’t need to navigate the cultural and linguistic barriers that European or American competitors face. They understand Asian business protocols while bringing Western transparency standards that Hong Kong’s sophisticated investors demand.

The Business Model: Three Entry Strategies for Australian Companies

Strategy 1: The Premium Turnkey Provider

Target Hong Kong’s 25,000+ high-net-worth individuals in luxury residential towers. Package includes:

- Complete regulatory navigation (building approvals, safety certificates, FiT applications)

- Structural engineering assessments

- Premium solar installation with aesthetic integration

- Smart home battery systems with AI optimization

- 20-year performance guarantees

- Concierge maintenance service

Value Proposition: “We handle everything. You just collect FiT payments and reduce your carbon footprint.”

Target Margin: 35-45% on HK$200,000-500,000 residential installations

Strategy 2: The Commercial Building Specialist

Focus on Hong Kong’s 15,000+ commercial and industrial buildings where more than 80% of FiT applications are for small-scale systems—mainly in detached houses, leaving the commercial sector massively underserved.

Partner with Hong Kong property management companies to offer:

- Energy-as-a-Service models (no upfront capital from building owners)

- Shared savings agreements (company owns system, splits FiT revenue with building)

- Corporate ESG reporting packages (helping multinationals meet sustainability targets)

- Integration with existing building management systems

Value Proposition: “Transform your rooftop liability into a revenue-generating ESG asset with zero capital outlay.”

Target Deal Size: HK$2-10 million per commercial building, 20-30 buildings/year = HK$40-300 million annual revenue potential

Strategy 3: The Technology Transfer Partner

Rather than compete on installation, partner with Hong Kong’s two electricity monopolies—Hong Kong Electric Company and CLP Power Hong Kong—to provide:

- Advanced grid integration software

- VPP management platforms

- Predictive maintenance AI systems

- Training programs for local technicians

The two utilities could help reduce bureaucratic hurdles by providing one-stop-shop solutions—and Australian companies can be the technology providers enabling this transformation.

Value Proposition: “We’ll make you the Tesla of Asian utilities—software-enabled, customer-centric, future-ready.”

Target Contract Value: HK$50-200 million multi-year technology licensing and support agreements

STRATEGY:

Secure Pilot Projects (Months 3-9)

- Target 3-5 mid-sized commercial buildings (2,000-5,000 m² roof space)

- Demonstrate one-stop regulatory navigation capability

- Document time-to-approval improvements vs. traditional approaches

- Generate case studies with financial returns data

Investment: HK$5-15 million in pilot installations

Scale Through Partnerships (Months 9-24)

- Formalize partnerships with Hong Kong property management companies

- Establish financing relationships with local banks

- Create standardized project templates for different building types

- Train local installation crews on Australian quality standards

Scale Target: 20-50 installations in year two

Platform Play (Year 2+)

- Launch digital platform connecting building owners, installers, financiers

- Aggregate multiple installations into portfolio for institutional investment

- Offer secondary market for FiT revenue streams (financial innovation)

- Expand to Macau and southern China markets using Hong Kong success

Required Steps to Enter the Hong Kong Market

Step 1: Establish Hong Kong Presence with a registered company (Months 1-3)

These are required by law and non-negotiable:

- Company incorporation filing fee: ~HKD 1,545–1,720 (one-time government fee to Companies Registry)

- Business Registration Certificate: HKD 2,200 for 1 year (to Inland Revenue Dept)

- Annual Return filing (statutory): ~HKD 105 (HKWJ Tax Law)

Total direct government cost: ~HKD 3,750–4,000 (~AUD 675–730) before professional services.

Ongoing functions, including:

- Company Secretary (annual): ~HKD 2,000–5,000

- Registered office address (annual): ~HKD 800–2,000

These are usually bundled into professional packages. Professional formation service fees: HKD 2,000–8,000+ (optional packages include document prep, submission, statutory books, initial compliance).

Typical realistic first-year compliance cost: ~HKD 6,000–12,000 (~AUD 1,080–2,150) including company secretary + address + basic filing fees.

Opening a bank account is a separate step and not included in company incorporation.

- Some banks charge no formal setup fee; others may charge a service or due-diligence fee around HKD 500–2,000.

- Minimum balance or initial deposit: often required (varies by bank). (恒诚–与远见者同行)

- After setup, monthly/annual account maintenance fees may apply if minimum balance thresholds aren’t met.

Many founders use an agent to help navigate bank requirements, especially if not physically in Hong Kong:

- Bank account assistance (agency fee): ~HKD 1,000–3,000 depending on provider and complexity. (恒诚–与远见者同行)

- For premium support with bank introductions and documentation prep, costs can be higher (several thousand HKD).

Note: Some digital or fintech-style providers (e.g., Airwallex, Neat, Statrys) may allow remote onboarding with lower fees vs traditional banks, but eligibility and feature sets differ from legacy corporate accounts.

Why Australian Companies Must Act Now

Market Timing is Critical

Hong Kong’s government has set a target of 3-4% renewable energy—still pathetically low but triple current levels. That represents 6,000-8,000 GWh of new capacity needed, or roughly HK$60-80 billion in infrastructure investment over the next 5-7 years.

More than 80% of applications are for small-scale systems of mainly in detached houses, meaning the lucrative commercial and high-rise residential markets remain virtually untapped.

Australia’s current privileged position in Hong Kong—trusted Western partner with Asian proximity—could erode as China tightens control or regional dynamics shift. The 2020s are the window for establishing market dominance before increased political complexity makes entry harder.

China exported 235.93 GW of PV modules in 2024, with the Asia-Pacific region importing 68.11 GW. Chinese manufacturers dominate hardware, but they lack the regulatory navigation expertise and service culture that premium Hong Kong clients demand.

That gap exists today. It may not exist in five years as Chinese companies develop sophistication in value-added services.

The Training Imperative: Cultural Competence Unlocks the Market

This is where Australia’s investment in cross-cultural business training becomes commercially critical, not academic, not nice-to-have, but profit-determinative.

Hong Kong’s solar blockage isn’t fundamentally technical or financial. It’s a communication and relationship problem:

- Building owners don’t trust installers’ claims about returns

- Regulatory officials fear being blamed if installations fail

- Property managers worry about liability without understanding risk mitigation

- Financiers lack standardized frameworks for assessing project viability

Australian companies that invest in Hong Kong-specific business protocols, relationship-building strategies, and regulatory navigation expertise will win deals that technically superior competitors lose because they couldn’t build the trust necessary to close.

Want to learn how to navigate Hong Kong’s business culture, crack regulatory barriers, and structure deals that win in Asia’s most complex markets? FNGN’s Asia Cross-Cultural Business Communications training gives you the frameworks Australian solar companies are using to capture multimillion-dollar contracts across the region. FIND OUT MORE >>> email ani@futurenowgreennews.com

Future Now Green News is a forward-thinking media platform dedicated to spotlighting the people, projects, and innovations driving the green & blue economy across Australia, Asia and Pacific region. Our mission is to inform, inspire, and connect changemakers through thought leadership and solutions-focused storytelling in sustainability, clean energy, regenerative tourism, climate action, and future-ready industries.