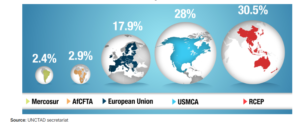

From panic to opportunity. Australia and Asian Pacific businesses are navigating U.S. tariffs and strengthening regional trade through RCEP 15 countries representing 30% global population, 30% global GDP + eliminating 90% tariffs between members.

The United States-Mexico-Canada Agreement (USMCA) is a free trade agreement between the United States, Mexico, and Canada formed in 2020 – now under pressure of being dismantled by Trump Tariff wars- and in effect, giving more bilateral trade from Canada and Mexico to the Australasia Pacific Region.

The Regional Comprehensive Economic Partnership (RCEP) was signed on 15 November 2020 during a virtual ASEAN Summit hosted by Vietnam. The agreement came into effect on 1 January 2022 which includes 15 member countries from the Asia-Pacific region of Australia, Brunei, Cambodia, China, Indonesia, Japan, South Korea, Laos, Malaysia, Myanmar, New Zealand, Philippines, Singapore, Thailand, and Vietnam.

Together, these 15 countries account for a population of about 2.3 billion = 30% of the world’s population, a total gross domestic product (GDP) of around $38,813 billion or 30% of global GDP – making RCEP the largest trade bloc in history.

RCEP aims to eliminate about 90% of tariffs among its 15 member countries over the next 20 years.

China is the world’s largest exporter and second-largest importer of goods, and when combined with the trade volumes of other Asian countries and Australia, the economic trade size is substantially larger than that of the United States. This region includes major economies like Japan, South Korea, India, and Southeast Asian nations, all of which have strong trade relations and economic activities. This region’s economic integration and trade agreements, such RCEP, further enhance its trade capabilities and resilience.

Regional Comprehensive Economic Partnership (RCEP):

In 2025, the Regional Comprehensive Economic Partnership (RCEP) could play a significant role in helping its member countries counter the impact of U.S. tariffs through several strategies. This initiative deepens economic integration between Australia-Asia-Pacific and reduces reliance on external markets like the U.S. By increasing intra-regional trade, RCEP countries can minimize the disruption caused by U.S. tariffs. For example, countries like China, Japan, and South Korea could increase trade with Southeast Asian nations instead of relying heavily on U.S. markets.

Australia, as a key member of RCEP, stands to benefit from strengthened trade ties within the region, reducing its dependency on U.S. markets and mitigating the impact of tariffs.

The U.S. tariffs on Chinese goods have caused many Asian countries and Australia to rethink their supply chains. Through RCEP, member countries can shift manufacturing and sourcing to other regional players that are not subject to tariffs. Vietnam, Malaysia, and Thailand, as part of RCEP, could become key hubs for manufacturing, drawing investment from U.S. companies looking to avoid tariffs on Chinese-made goods.

RCEP not only addresses tariffs on goods but also provides greater access to services markets. By expanding trade in services like finance, technology, and digital services, RCEP members can compensate for any lost opportunities from U.S. tariffs on goods. Countries like India and the Philippines, known for their IT and business process outsourcing (BPO) industries, could leverage RCEP to expand service exports to the region and reduce reliance on the U.S.

RCEP encourages foreign direct investment (FDI) among its members. In response to U.S. tariffs, countries could attract more investment in sectors like renewable energy, technology, and manufacturing by offering favorable conditions for investors looking to bypass U.S. tariffs. As RCEP reduces barriers to investment and provides a more predictable environment, countries could see a surge in investment from companies seeking alternative markets in the region.

RCEP countries can further strengthen trade relations with non-member countries through bilateral or multilateral agreements, ensuring that they can continue to access global markets while circumventing U.S. tariffs.

ASEAN countries, through RCEP, could negotiate additional trade deals with the EU or other emerging markets to bolster exports in sectors impacted by U.S. tariffs.

By enhancing trade among RCEP countries, member nations could increase local production of goods and reduce dependency on imports from the U.S., especially in key sectors like electronics, textiles, and agriculture. With Chinese manufacturing being disrupted by tariffs, Southeast Asian countries could increase their production capacity, providing goods that would have otherwise been sourced from the U.S. or China.

Some RCEP countries may implement counter-tariffs on U.S. goods, especially in industries where the U.S. is a major exporter. This could create a balancing effect that reduces the impact of U.S. tariffs. China, a key RCEP member, could continue to impose tariffs on U.S. agricultural products, while countries like Japan and South Korea could target U.S. automotive exports.

By fostering regional cooperation and reducing reliance on the U.S. market, RCEP members can better manage the challenges posed by U.S. tariffs and maintain strong, resilient economies in the face of global trade tensions.

UNCTAD’s analysis shows Japan would benefit the most from RCEP tariff concessions, largely because of trade diversion effects. The country’s exports are expected to rise by about $20 billion, an increase equivalent to about 5.5% relative to its exports to RCEP members in 2019.