With a Global average of a 69% drop in species populations since 1970 – 1.5 > 2.0C temperature increases e will dramatically modify the size and quantity of habitats in the world’s ecosystems.

Image Credit CC: Hazif Issadene

Nature has various ways to adapt to climate change, such as wildlife moving to more suitable habitats, changes in pollination and migration patterns, and shifts in the spatial footprint of barrier islands and salt marshes.

To address climate change, it is crucial for affected communities and economic sectors to understand, protect, and enhance the adaptive processes of natural systems.

However, nature is experiencing an unprecedented decline. According to the World Wildlife Fund’s (WWF’s) 2022 Living Planet Index, there has been an average 69% decrease in species populations globally since 1970. Additionally, the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) reports that the condition of natural ecosystems has deteriorated by 47% on average compared to their earliest estimated states.

This degradation is exacerbated by human-induced climate change, one of the five main drivers of nature and biodiversity loss. With global temperatures projected to rise by at least 1.5°C to 2.0°C by the end of this century, climate change will significantly alter the size and quality of habitats worldwide, leading to severe consequences for species biodiversity and ecosystems.

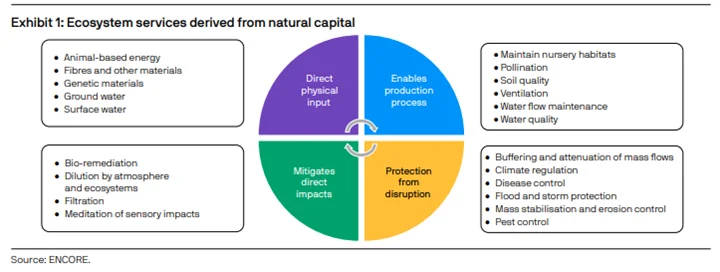

Recent research by PwC highlights the financial value of nature’s contribution to the global economy, revealing that 55% of the world’s GDP—equivalent to USD 58 trillion—is at risk due to nature-related factors. This is particularly true for industries such as agriculture, forestry, and food and beverage, which are entirely dependent on nature for their operations.

World Bank analysis has found that even a moderate level of collapse in ecosystem services, such as wild pollination, and the provision of food from marine fisheries and timber from native forests, could result in a decline in global GDP of USD 2.7 trillion by 2030.6 And recent research suggests that a substantial 35% of the MSCI ACWI, equating to over USD 28 trillion in market capitalisation, is exposed to biodiversity risk in some way.

Quite simply, without adaptive measures to reduce the exploitation of natural capital, slow climate change related ecosystem declines and promote nature-based solutions for adaptation, these potential losses could become reality.

READ JP Morgan full Report HERE+