Photo credit: Markus Winkler

The insurance industry is undergoing a transformative shift, with Environmental, Social, and Governance (ESG) considerations taking center stage.

PwC’s recent ESG survey in the Asia Pacific (APAC) region sheds light on critical issues faced by insurers, their responses, and the path toward sustainable practices. This is an expert on PwC’s Survey. Please read more >>

The survey insight showed 56% of respondents have a high-level preliminary understanding of ESG requirements. Countries like Singapore, Japan, and Malaysia lead in preparedness due to strong regulatory pushes for climate risk management and ESG. Regulatory impetus drives awareness and understanding.

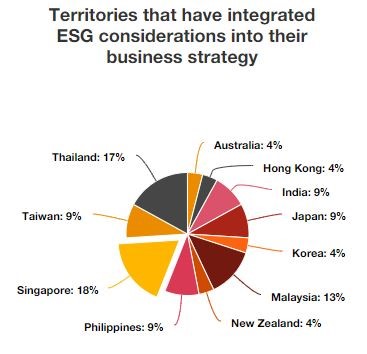

Austral Asia Pacific region ESG integration into business strategy

Source: PwC Insurance survey

ESG Beyond Compliance:

ESG is no longer merely about regulatory compliance. It encompasses principles that span investments, sustainable innovation, risk management, and long-term outcomes. Insurers recognize the emerging risks of not embedding ESG into their core operations.

APAC Context:

Rising regulatory requirements drive ESG adoption in the APAC region, especially within the insurance industry. Parent companies in regions with higher ESG maturity influence awareness and action.

Survey Insights

Integration into Business:

49% of respondents have integrated ESG considerations into their investment policies. 42% have embedded ESG into their business strategy and risk identification process.

Risk Management and Scenario Analysis:

Insurers are actively incorporating ESG frameworks into their risk management strategies. Scenario analysis for ESG-related risks is gaining prominence.

Timelines and Sustainability:

Setting clear timelines for ESG implementation is crucial. Insurers are exploring ways to sustain ESG frameworks through technology and innovation.

Guiding Decision-Makers

This survey report serves as a compass for insurance industry decision-makers, addressing key areas:

Getting Started:

-

- Assess preparedness to implement ESG frameworks.

- Understand the compliance landscape.

- Define metrics for monitoring ESG risk.

Embedding ESG:

-

- Integrate ESG into risk management strategies.

- Leverage scenario analysis for informed decision-making.

Sustainability:

-

- Develop datasets to benchmark against industry best practices.

- Embrace technology and innovation for lasting ESG impact.

Conclusion

The APAC insurance industry stands at a critical juncture. By embracing ESG principles, insurers can navigate risks, drive sustainable growth, and contribute to a resilient future. Let this survey guide decision-makers toward a more responsible and impactful path.

Disclaimer: The information provided in this article is based on publicly available sources and does not constitute legal or financial advice. Readers are encouraged to consult official reports and seek professional advice for specific compliance requirements.

Caption: PwC Insurance survey