AT FutureNow Green News, we spend far less time chasing headlines and far more time looking for signals, early indicators that something is moving from promise to practice.

In climate and clean technology, those signals rarely arrive with fanfare, and they show up in procurement decisions, pilot extensions, quiet policy shifts, industrial retrofits, and infrastructure that starts working so well it barely gets noticed.

What’s emerging as we head into 2026 isn’t a single breakthrough or magic answer, but a clear pattern. The most credible climate solutions are appearing at the intersections: energy and water, heat and materials, software and infrastructure, waste and value. This is climate tech maturing, and the era of standalone fixes and speculative concepts is giving way to integrated systems that solve multiple problems at once… and, critically, begin to stand on their own economics.

There’s also a deeper geopolitical layer to this next phase.

Clean technology is no longer just an emissions story as it’s become more focussed on Energy Security, industrial competitiveness, and supply-chain resilience. From green iron and long-duration storage to hydrogen carriers and smarter grids, nations are quietly positioning themselves for a world where climate ambition and economic strategy are inseparable. Australia and Asia sit at the centre of that realignment, but only if we move beyond pilots or failed projects from jumping too soon, and into repeatable, exportable scale.

Another uncomfortable truth: many of the technologies that will matter most in 2026 won’t look especially revolutionary. They’ll look practical. Electrified industrial heat. Better batteries. Smarter grid software. Fewer leaks, fewer outages, higher utilisation. History shows that infrastructure transitions are won by reliable ideas. In climate tech, “boring” often turns out to be another word for scalable, and scalable is what actually shifts systems.

With that lens firmly in place, here are 20 climate and clean-tech breakthroughs worth keeping an eye on — and genuinely being excited about — as we begin 2026. Not because they make for good hype, but because they’re beginning to demonstrate the attributes we look for at FNGN: real-world performance, falling costs, credible pathways to scale, and the potential to move from niche solutions to industrial defaults.

Note: In keeping with Future Now Green News’ editorial approach, these examples are cited as signals of momentum, not endorsements. The real story lies in performance, transparency and scale. Of course, if your business/company could have easily made this list, we’d love to hear from you – editor@futurenowgreennews.com

1) Waste-heat “ocean refinery” systems: desalination + green hydrogen in one loop

The emergence of integrated systems that combine seawater desalination with green hydrogen production — powered by industrial waste heat — represents a quiet but important shift in thinking. Instead of treating desalination, hydrogen, and industrial cooling as separate challenges, these systems treat them as parts of the same equation. Seawater becomes an input, waste heat becomes an asset, and outputs include fresh water, hydrogen, and manageable brine.

What makes this model compelling isn’t novelty, but logic. Industrial coastal zones already struggle with heat rejection, water scarcity, and decarbonisation pressure. If these systems prove replicable, they offer a blueprint for turning environmental constraints into stacked value streams.

Why 2026 is important: replication and economics. The key signal will be whether these projects move beyond one-off pilots into repeatable industrial deployments across Asia and beyond.

Signal examples…

Rizhao Integrated Seawater–Hydrogen Pilot (Rizhao, China)

ENOWA Industrial Waste Heat Recovery + Desal Concepts (NEOM, Saudi Arabia)

2) Perovskite – silicon tandem solar: the efficiency leap moving from lab to modules

Tandem solar cells — layering perovskites on top of silicon — promise a step-change in efficiency beyond what traditional silicon panels can deliver. After years of lab success and durability scepticism, the technology is edging toward early commercial reality, with manufacturers reporting improved stability and scaled manufacturing processes.

This matters because solar’s next gains won’t come from marginal cost reductions alone. Higher efficiency means more power from the same land, rooftops, and infrastructure — a critical factor in dense cities and constrained grids across Asia-Pacific.

Why 2026 is important: bankability. The story beyond record efficiency is whether financiers treat tandem like “real solar,” not science fair.

Signal examples…

Oxford PV (UK / Germany)

LONGi Tandem Cell Program (Xi’an, China)

3) Sodium-ion batteries: cheaper chemistry for the parts of the market that matter most

Sodium-ion batteries won’t replace lithium-ion everywhere and they don’t really need to. Their appeal lies in cost, material abundance, and safety, particularly for stationary storage, micro-mobility, and two- and three-wheel vehicles across Asia. With major manufacturers signalling mass production timelines, sodium-ion is moving out of the lab and into supply chains.

In a world increasingly concerned about lithium, nickel, and cobalt constraints, sodium-ion offers diversification and resilience. It’s a reminder that “good enough” technology often scales faster than perfection.

Why 2026 is important: deployment at scale. Watch grid storage tenders and emerging-market mobility, where cost and safety trump energy density.

Signal examples:

CATL sodium-ion battery line (Ningde, China)

Faradion / Reliance Industries (India)

4) Long-duration energy storage (LDES): beyond four hours and into grid reality

As renewable penetration rises, the limits of short-duration lithium storage are becoming clear. Enter long-duration energy storage: iron-air batteries, CO₂-based storage systems, gravity and pumped hydro variants, and thermal storage concepts designed to deliver power for 8, 24, or even 100 hours.

This is about ‘complementing’ lithium. Grids need duration diversity, and the next phase is less about technological novelty and more about integration into planning and market rules.

Why 2026 is important: procurement signals. When utilities start buying “hours” as a product category, LDES becomes infrastructure, not experimentation.

Signal examples…

Form Energy iron-air batteries (USA)

Energy Dome CO₂ Battery (Italy)

5) Australia’s LDES pilots: proving ideas on one of the world’s toughest grids

Australia’s National Electricity Market is emerging as a proving ground for long-duration energy storage, with pilots spanning flow batteries, hybrid thermal systems, and pumped hydro variations. The value here is learning how these technologies behave under extreme price volatility and renewable swings, not just capacity.

Australia’s grid conditions make it an ideal stress test. And it’s more than likely what works here is far more likely to work elsewhere.

Why 2026 is important: exportable expertise. Success positions Australia as a global reference market for LDES design and operation and not just as a project host.

Signal examples…

Invinity Energy Systems vanadium flow batteries (South Australia / UK) (Queensland, Australia)

Hydrostor advanced compressed air projects (NSW, Australia / Canada)

6) Next-generation geothermal: clean, firm power without the fossil baggage

Enhanced and closed-loop geothermal systems promise 24/7 clean power without combustion or weather dependence. By applying advanced drilling techniques and closed-loop designs, developers are targeting regions previously considered unsuitable for geothermal energy.

This is particularly relevant for grids seeking firm power without gas. Geothermal’s biggest challenge has never been physics — it’s been a mix of cost, risk and perception.

Why 2026 is important: contracts. When utilities sign long-term power purchase agreements, geothermal crosses from curiosity into core infrastructure.

Signal examples…

Fervo Energy enhanced geothermal (Nevada, USA)

Eavor closed-loop geothermal (Germany / Alberta, Canada)

7) Green iron and green steel: decarbonising the backbone of modern civilisation

Steelmaking accounts for a significant share of global emissions (7%-8% according to the World Steel Association), and hydrogen-based direct reduced iron (DRI) offers a credible path to change that. The shift toward green iron — producing low-carbon feedstock close to renewable energy sources — is especially relevant for Australia.

The big question is where will it be made and who captures the value.

Why 2026 is important: offtake agreements. Put ambition aside, please, the winners will be those who lock in buyers, power, and logistics.

Signal examples:

H2 Green Steel (Parkes and Whyalla, Australia)

Fortescue green iron initiatives (Pilbara, Australia)

8) Low-carbon cement: reducing emissions without rebuilding the industry from scratch

Cement’s emissions problem is as much chemical as it is energetic. It’s not jut about how it’s heated; solutions like LC3 and clinker substitution reduce emissions by changing what cement is made from. That matters because it works with existing plants and standards.

Incremental chemistry changes can deliver outsized impact… if regulators and builders accept them.

Why 2026 is important: codes and standards. Cement decarbonisation is ultimately a regulatory and procurement story.

Signal examples…

LC3 Project (India/Cuba/Switzerland)

Holcim low-carbon cement portfolio (Global)

9) Electrified industrial heat: the hidden giant of decarbonisation

Industrial heat underpins everything from food to chemicals to metals and it’s still largely fossil-fuelled. Electrified boilers, thermal batteries, and high-temperature heat pumps are beginning to change that equation.

This transition won’t grab headlines, but it will quietly cut emissions at scale.

Why 2026 is important: economics and carbon pricing. When electrified heat beats gas on cost, adoption accelerates rapidly.

Signal examples…

Rondo Energy heat batteries (California, USA)

Calix electrified calcination technology (Australia)

10) Sustainable aviation fuel (SAF): moving from ambition to supply chains

SAF is moving beyond theoretical solution and fast becoming a procurement requirement. Asia-Pacific airlines and governments are increasingly setting blending targets and exploring local feedstocks and production hubs.

The constraint is supply and not demand.

Why 2026 is important: early volumes. Whoever builds credible SAF supply chains now will shape aviation decarbonisation for decades.

Signal examples…

Neste SAF production (Singapore/Finland)

LanzaJet alcohol-to-jet fuel plant (Georgia, USA)

11) E-fuels: energy-intensive, unavoidable and strategically important

Power-to-liquids e-fuels remain expensive and energy-hungry, but for long-haul aviation and shipping they may be unavoidable. The question is whether clean power becomes cheap enough and not so much as whether it’s perfect.

Australia’s renewable potential makes it a natural contender, if infrastructure follows.

Why 2026 is important: policy clarity. Mandates and incentives will determine whether e-fuels remain niche or scale.

Signal examples…

Haru Oni e-fuel pilot (Patagonia, Chile)

HIF Global synthetic fuels (Chile/Australia-linked studies)

12) Hydrogen carriers and ammonia cracking: solving the transport bottleneck

Hydrogen’s biggest challenge is its movement, because there’s no doubt once it gets going properly it will be produced abundantly. Ammonia cracking, liquid organic carriers and port infrastructure are becoming central to the hydrogen conversation, particularly in Asia-linked trade routes.

The technology race is about efficiency, safety and reliability.

Why 2026 is important: first functioning corridors. Proof beats theory every time.

Signal examples…

Kawasaki Heavy Industries hydrogen carrier systems (Japan)

Element One (Newcastle, Australia)

13) Methane pyrolysis: hydrogen without combustion emissions

Turquoise hydrogen splits methane into hydrogen and solid carbon, avoiding direct CO₂ emissions. The climate value depends on methane leakage control and what’s done with the carbon, but the concept is gaining industrial interest.

If solid carbon becomes a usable material, economics shift quickly.

Why 2026 is important: partnerships with heavy industry. Integration is everything here.

Signal examples…

Monolith Materials (Nebraska, USA)

Hazer Group methane pyrolysis technology (Perth, Australia)

14) Direct air capture (DAC): carbon removal under real scrutiny

DAC has moved beyond hype and into accountability. Costs remain high, but learning curves are real and scrutiny is healthy. Measurement, verification and uptime now matter more than ambition.

Carbon removal will survive only if it earns trust.

Why 2026 is important: transparency. Credible operators will separate themselves from wishful thinking.

Signal examples…

Climeworks DAC plants (Iceland)

CarbonCapture Inc modular DAC systems (USA)

15) Carbon mineralisation: storing CO₂ the way geology intended

Mineralisation turns CO₂ into solid rock, offering permanence that few other solutions can match. Whether via basalt formations or mine tailings, this approach appeals to those seeking durable storage.

The challenge lies in scaling measurement and logistics.

Why 2026 is important: industrial integration. Pairing storage with emitters is the next step.

Signal examples…

Carbfix CO₂ mineralisation (Iceland)

Mineral Carbonation International (Newcastle, Australia)

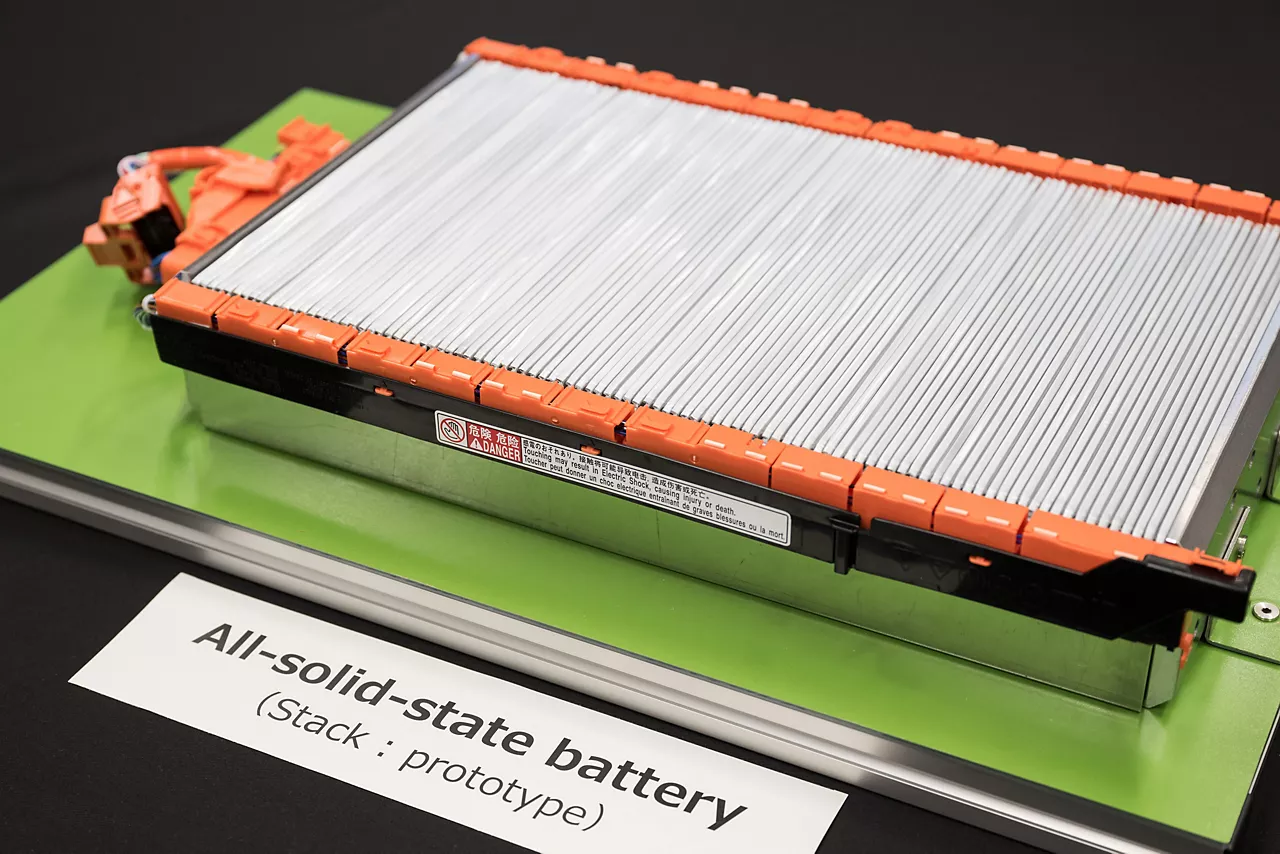

16) Solid-state and lithium-metal batteries: incremental progress, meaningful impact

Solid-state batteries remain difficult, but steady advances continue. Even limited deployment in premium or safety-critical applications could have ripple effects across energy storage.

Breakthroughs here tend to be evolutionary and not so much explosive.

Why 2026 is important: first credible commercial footprints.

Signal examples…

QuantumScape (California, USA)

Toyota solid-state battery program (Japan)

17) Battery recycling and circular minerals: the unsung enabler of electrification

As battery volumes grow, recycling becomes essential infrastructure. Recovering lithium, nickel and cobalt reduces environmental impact and supply risk, and positions resource-rich countries like Australia strategically.

This is where sustainability meets industrial policy.

Why 2026 is important: feedstock access. Recycling scales only if materials flow reliably.

Signal examples…

Li-Cycle (Canada/Asia expansion)

Neometals battery recycling (Australia/Europe)

18) AI for grids: making renewable systems work better, not just bigger

AI is increasingly being deployed to optimise dispatch, forecast renewables, detect faults and reduce congestion. The result isn’t flashy, it’s fewer outages and less wasted power.

And that’s exactly the point.

Why 2026 is important: utility adoption. Reliability sells.

Signal examples…

AutoGrid grid optimisation software (USA)

Neara grid modelling platform (Sydney, Australia)

19) Methane detection: the fastest climate win hiding in plain sight

Methane is a potent short-term warming agent, and detecting leaks is one of the quickest ways to reduce emissions. Satellites, drones and continuous monitoring are turning invisibility into accountability.

This is climate action with immediate impact.

Why 2026 is important: enforcement. Measurement enables regulation.

Signal examples:

GHGSat methane-monitoring satellites (Canada)

Kayrros methane analytics (France)

20) Ocean-based carbon solutions: promise, peril, and the need for guardrails

Ocean alkalinity enhancement and seaweed-based systems offer tantalising potential — and serious governance challenges. The breakthroughs to watch aren’t just chemical, but institutional: measurement, safety, and standards.

This space demands caution as much as creativity.

Why 2026 is important: rules of engagement. Without guardrails, progress stalls.

Signal examples…

Planetary Technologies ocean alkalinity pilots (Canada)

Running Tide seaweed-based carbon systems (USA)

Future Now Green News is a forward-thinking media platform dedicated to spotlighting the people, projects, and innovations driving the green & blue economy across Australia, Asia and Pacific region. Our mission is to inform, inspire, and connect changemakers through thought leadership and solutions-focused storytelling in sustainability, clean energy, regenerative tourism, climate action, and future-ready industries. Feel free to contact the editor at editor@futurenowgreennews.com